One of the trickiest things about neurotechnology is defining segments accurately. A web search turns up dozens of reports and estimates about BCI, neuromodulation, productivity tech, diagnostics, imaging, monitoring, AI, and other topics.

Who is buying neurotech? What are the categories and estimated sizes? After thinking about this too much, for a year, I’ve arrived at these five segments:

Consumer wearables ($1b)

Clinical diagnostics & monitoring ($7b)

Clinical treatment & intervention ($8b)

Life sciences ($6b)

Research & manufacturing ($2b)

Quick notes before diving in:

Many vendors straddle segments; any estimates are somewhat overlapping. To neurotech companies, category matters far less than product/market fit, business model, and sales.

So, this whole question of segmentation is more of a lens for investors or corporate partners, or analysts with too much time on their hands.

This frames COMMERCIAL MARKETS. Not neurotech writ large, which is (too) academic and technically oriented, aka an early or frontier market. That matters: “Why commercialization? As these sophisticated tools leave the STEM labs and enter everyday markets, it will be critical for consumers and patients, family members, advocates, ethicists, clinical leaders, business partners and investors to navigate the hype and make sense of what’s real, what’s not, and what’s coming.”

Let’s start with the Bird’s Eye.

My Kingdom for a Market Map

People just love market maps. Given the first bullet above I’ve held off making one so far. But here are some I’ve found that have helped shape and refine my thinking.

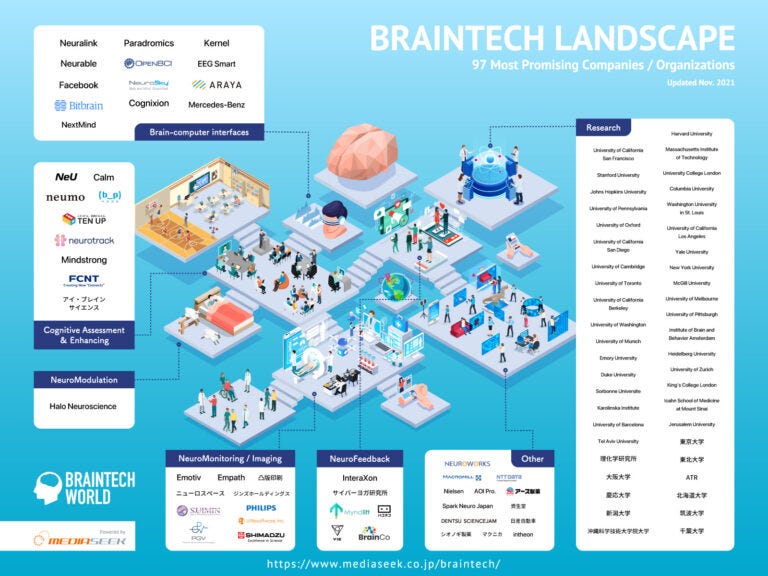

Candy can hurt your eyes, but let’s start with the prettiest, from MediaSeek (2021):

Fellow Japanese firm Neurotech JP’s map focuses on BCI (2022):

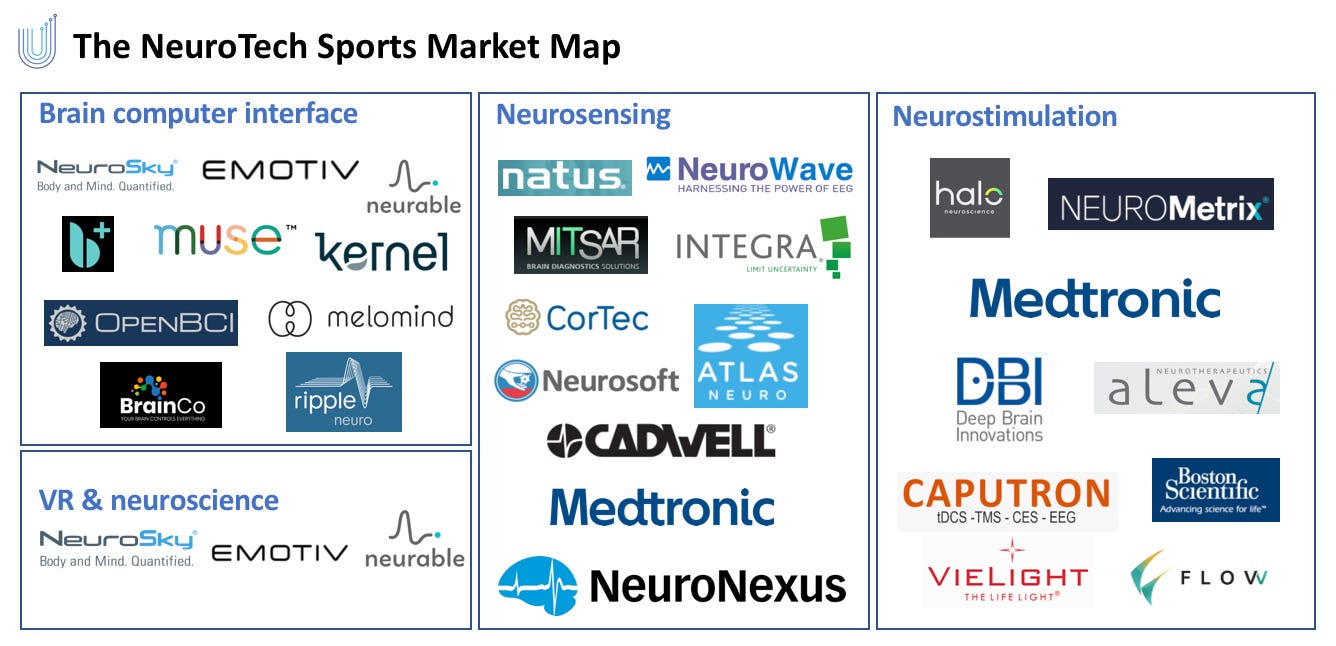

For a sporty neurotech lens, see The Upside’s (2022):

More logos? Check. Enter Neurotech Analytics (2020):

I found the latter superior in terms of segments. But what I didn’t love (in all of them) was the focus on technology, not the market.

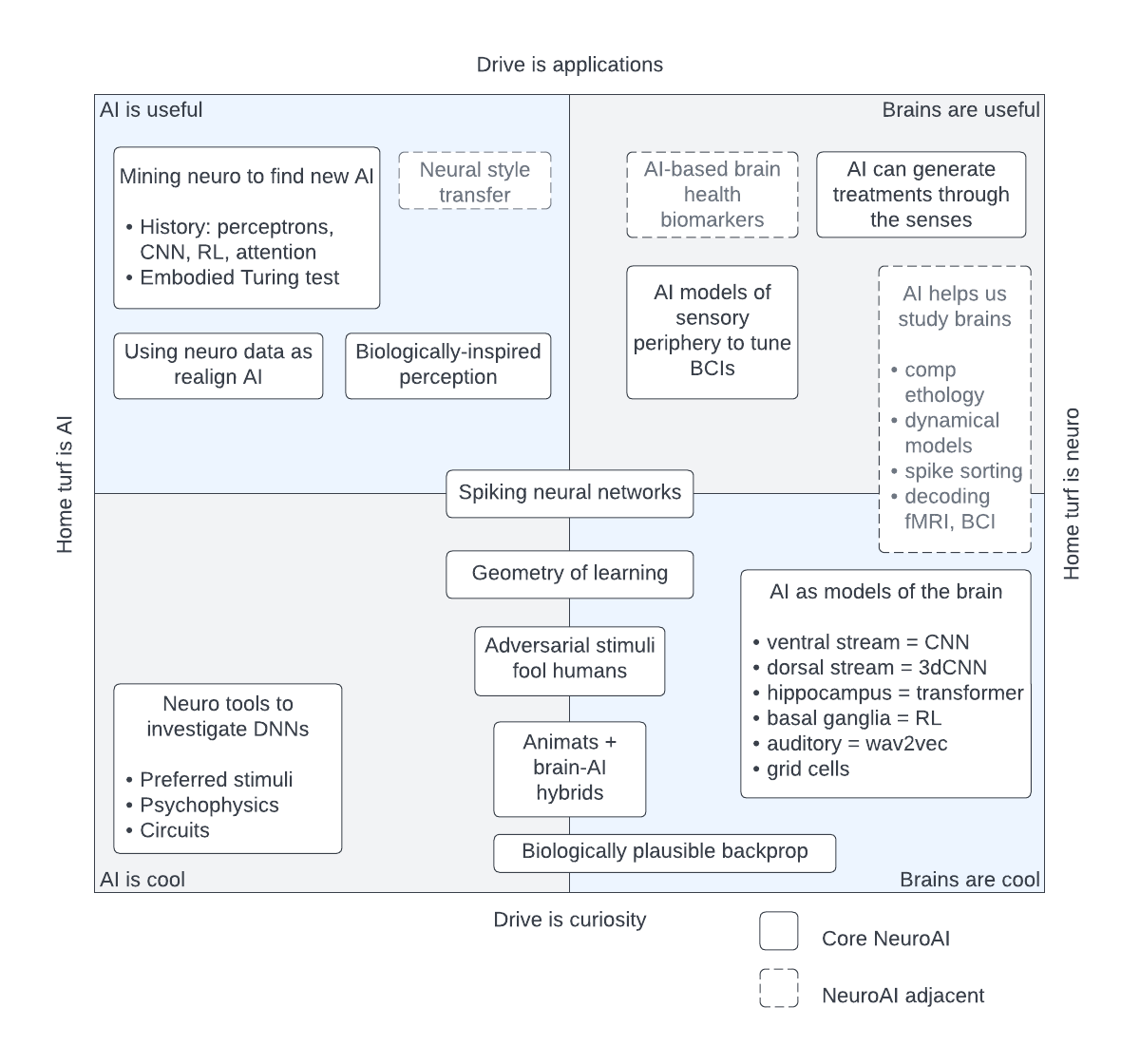

Tech is obviously critical. But, it doesn’t say much of anything (to me) on its own. As a non-engineer, for instance, I found this schema from fellow substacker Patrick Mineault interesting, but wayyy over my head:

There are plenty more maps out there, and not to throw shade at my fellow analysts (🫶🏽)but this sampling sums up the basic state of market research in neurotech: obsessive interest about gizmos and tech like “brain computer interface” or “neuromodulation” or this thing called “AI” - rather than critical thinking about who is actually paying money to use this tech to help people.

Now, let’s explore our commercial segments, which are areas where companies have established product-market fit, which is the bull’s eye: paid applications that bring neurotechnology into contact with real, live human beings.

What follows is a snapshot and trends analysis rather than a teardown or deep dive, which we’ll be getting into segment by segment in the weeks ahead.