Teardown: Transcranial Magnetic Stimulation

Inside The Most Polarizing Neurotech Market

To understand the commercial future of neurotech, there’s no better place to start than by exploring today’s transcranial magnetic stimulation market.

TMS has been commercially available in the US for over 20 years. Milan Cvitkovic’s history and overview is a great starting point for general orientation.

If you don’t like reading, well you’ve really come to the wrong place but, tl;dr on TMS:

The clinical evidence for patients is promising, but the economic evidence for populations is not. Not yet.

First things first. What is it? TMS is “a non-invasive brain stimulation technology used for basic science, translational research, and therapy in a wide range of neurological and psychiatric disorders.”

It works by pulsing electrical current through a coil (or a helmet), which produces a magnetic field that permeates the skull in targeted locations. By depolarizing neurons, this type of stimulation changes electricity and alters brain chemistry.

Typical of neurotechnology, TMS is complicated, coming in a variety of flavors that vary by intensity, pattern, duration, frequency, and much more. These include but are not limited to: single pulse (sTMS), repetitive (rTMS), deep TMS (dTMS), accelerated TMS (aTMS), navigated TMS (nTMS) used for therapy as well as diagnostic purposes (typically before brain surgery), and intermittent Theta Burst Stimulation (iTBS).

rTMS is the most commonly used and discussed for treatment-resistant depression (TRD). To simplify, we’ll refer to all of the above mentioned modalities as just “TMS.”

In this teardown, we’ll have a bird’s eye look around the US commercial market using all-payer data, break down the market opportunity using public filings from leading TMS vendors, explore other trends, pressures, and barriers.

How big is the TMS market?

A Quick Commercial Overview

Understanding Business Models

What’s next for TMS?

We’ll mainly consider the market for TRD, but visit other indications too.

Teardowns are for paying members only, but the first section is available for everyone. If you value original neurotech analysis, you can upgrade for the cost of a cup of coffee per week (Apparently it’s a neurostimulator.) Or, see our new reader referral program.

1. How Big is the TMS Market?

How many patients received TMS treatment in the US last year for treatment resistant depression (TRD)?

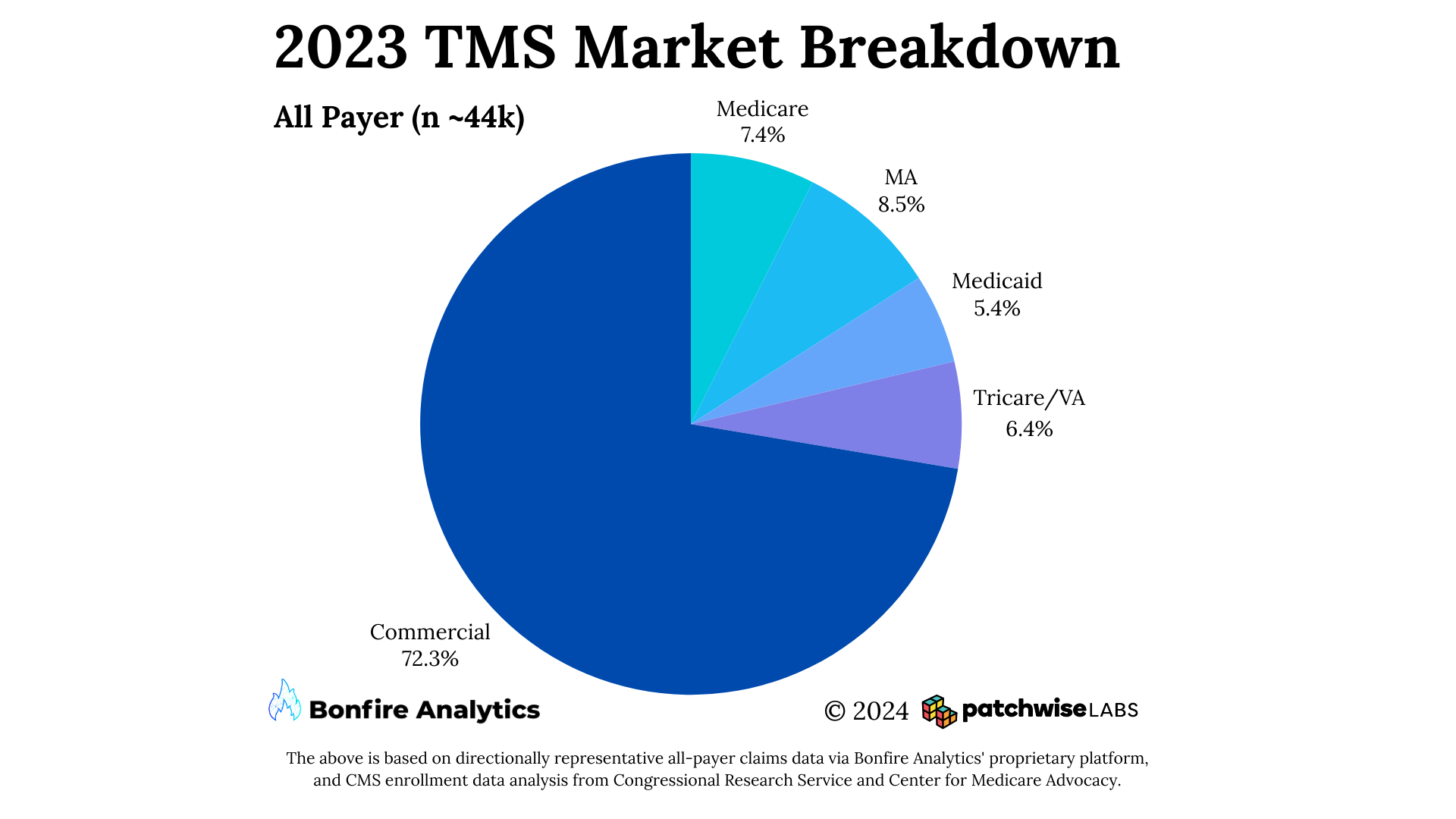

In 2023, 44,000+ patients received TMS treatment for TRD in the US, according to our original research, powered by Bonfire Analytics.

A note about the data: Bonfire Analytics’ platform provides directionally representative data based on 2022-2023 claims from Commercial, Medicare, Medicare Advantage, Medicaid, Tricare/VA, and other programs. The analyses below incorporate these data alongside CMS enrollment figures drawn from Congressional Research Service and the Center for Medicare Advocacy. Together this represents a “best estimate” snapshot of 2023’s TMS market for TRD.

The vast majority of people access TMS treatments through commercial insurance. Further analysis of billed claims versus treated patients suggests an average of 28 sessions per patient. These data capture active utilization of TMS treatment. But they don’t speak to the broader pool of patients eligible for TMS therapy.

Analysis of ICD-10 codes reveals a much broader market and drastic unmet needs. The red numbers below estimate the total count of eligible patients (light blue) and the actual number and percentage (red) who received treatment last year.

Zooming out: Given inherent limitations in data reporting and the nature of underdiagnosis of treatment resistant depression, even a conservative estimate of total eligible population for TMS still underrepresents actual unmet patient need.

While TMS is not the best treatment available for every patient, the industry’s failure to capture even one percent of the eligible population begs further exploration of product/market fit and a comparative analysis across payers.

Various published reports estimate the total TMS market is “worth” $1.1-$1.4 billion a year, growing at a compounded rate of ~10% per year. While these numbers are plausible when considering the global market, I believe they’re misleading as they overblow revenue and under-examine profit.

My fairly conservative estimate on 2023 market size in the US is ~$425m. This is based on analysis of billed claims data, along with private data explored below.

That’s revenue, not profit, which is the punchline to this whole analysis.

Next let’s dive into companies, business models, revenue, and market strategy.