2025 Neurotech Funding Snapshot

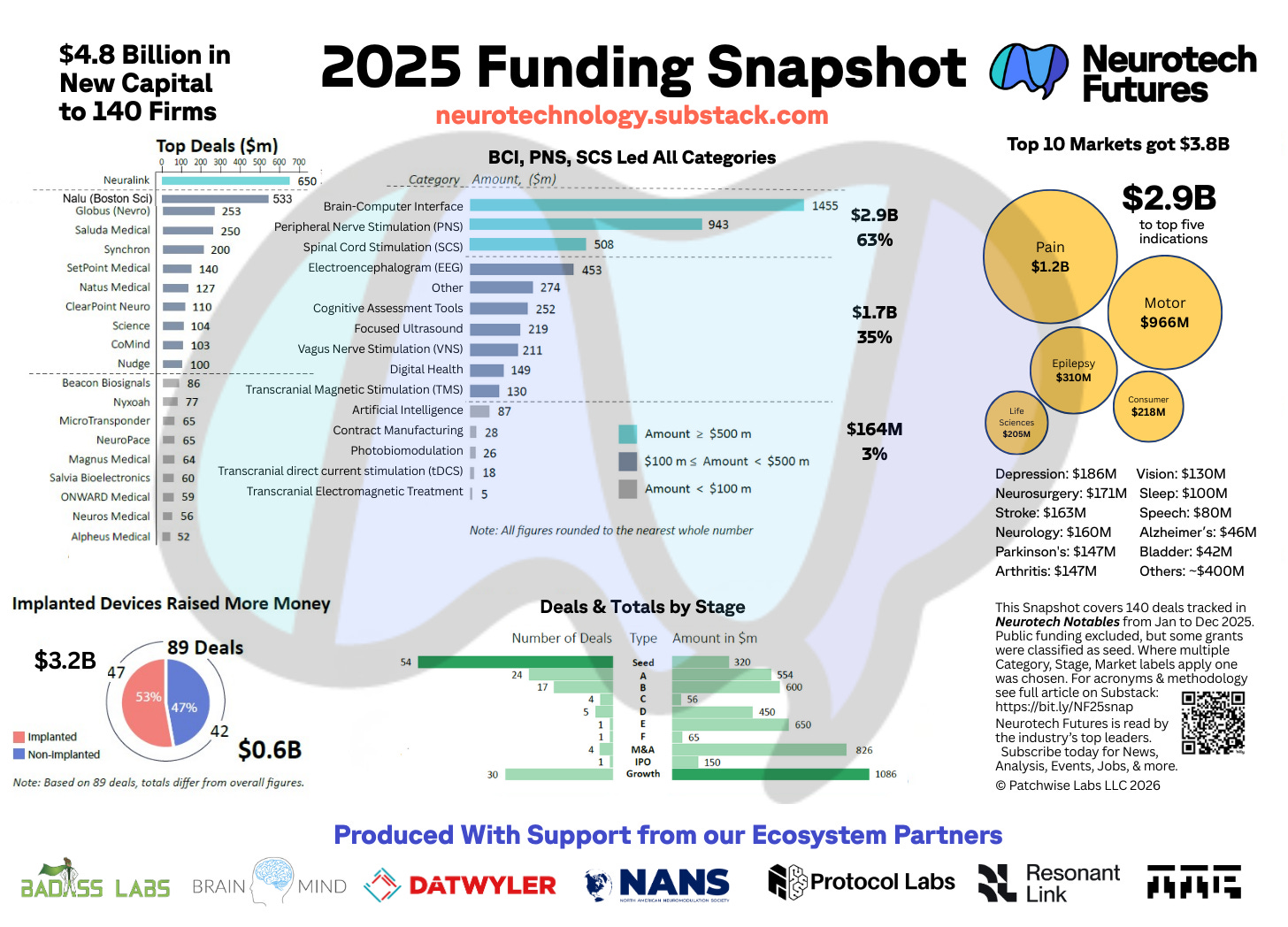

$4.8 Billion across 140 deals

2024’s funding snapshot made the rounds last year, so here’s the sequel: An overview of 2025’s private investments in neurotech companies.

This meta analysis explores one question from several angles: What can we learn about commercial neurotech markets by analyzing new capital entering the industry?

Like last time, methodology is at the end, with specific notes in each section. The same Three Major Caveats about how I selected, filtered, categorized, and presented these data still apply.

Compared to last year I am more crunched for time this year and will be publishing the full set of charts and analysis over the course of several posts this month:

Overview and summary by deal stage (this one)

Category and Implanted vs. Noninvasive

Market, Timeline and Geography

My goal for this series and Substack in general is to catalyze the growth of the industry by attracting new investors and backers across VC, PE, LP, non-profits, and other funders and leaders.

So while this analysis - like any - may be subjective and approximate, I still hope it helps investors refine and expand their theses, while providing founders and operators with intelligence on positioning, timing, and competition. Lastly, I encourage job searchers to explore which companies and segments have money for hiring, and then go hunting on their websites or our job board.

🙏🏽 A special thanks to Audree Rumberger and Jessa Gamble for their help with data analysis. Super Shoutout to BrainMind and Satori Neuro for their leadership and collaboration in helping me produce this report. Credit to our other ecosystem partners without whose support this analysis would not have been possible: BADASS Labs, Datwyler, NANS, Resonant Link Medical, TTP