None The WISeR: New Medicare AI Leaves Neurotech In Denial

Bad News for Implanted Neurotech

Despite its growing “deeptech” bonafides, the US neurotechnology industry has wound up on the wrong side of AI.

The Centers for Medicare and Medicaid Services (CMS) announced a new pilot program to test whether AI-enabled claim denials will save money. How? By automatically reducing the use of implanted neurostimulation and other service categories "that may be fraudulent, and wasteful, or of low-value and medically unnecessary."

The Wasteful and Inappropriate Service Reduction (WISeR) Model is an initiative from the Center for Medicare and Medicaid Innovation (CMMI). Key details:

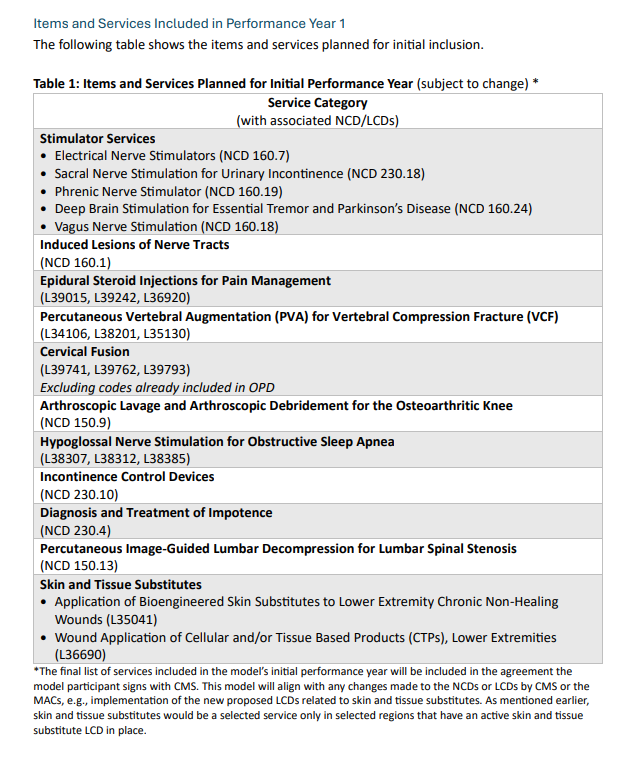

What: Reimbursement claims for 17 specific services, including six implanted neurotech treatments, will be automatically flagged for further medical review using AI. Physicians will receive a cut of the savings generated by denied claims.

When: Six years, starting from January 1, 2026 to December 31, 2031.

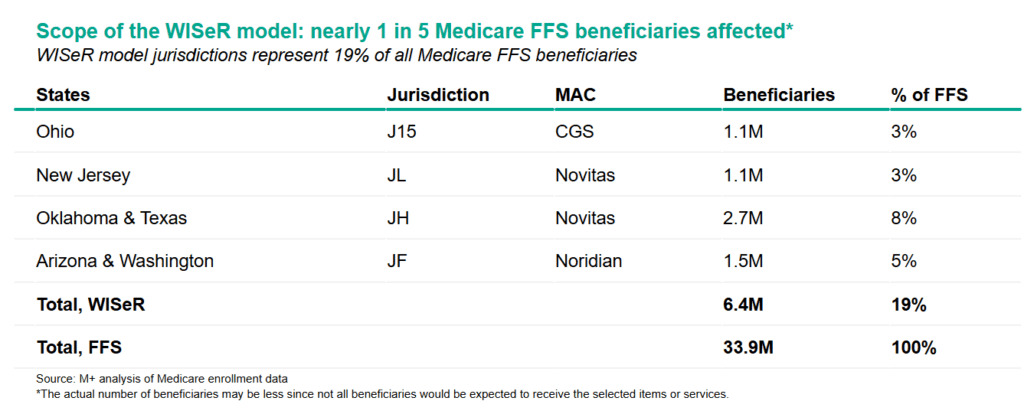

Where: Throughout six states: New Jersey, Ohio, Oklahoma, Texas, Arizona and Washington.

How: Companies with AI expertise will help streamline automatic denials through the Prior Authorization process. CMS solicited participation via request for applications (RFA) from “companies that apply emerging technologies to clinical and claims processing solutions and have experience and expertise managing the prior authorization process for other payers, including Medicare Advantage (MA) plans, with a demonstrated ability to apply such technology to the payment processes used under Original Medicare.”

A fact sheet states that “WISeR does not change Medicare coverage or payment policy,” for these services, but rather, aims to reduce their use by modifying physician practice behavior. The announcement declares that “human clinicians, not AI, will make final coverage decisions." The model excludes hospital-only and emergency services, emergency services, as well as “services that would pose a substantial risk to patients if significantly delayed.”

Prior Authorization On Steroids

In a word, WISeR is extreme.

Prior authorization (PA) is a business practice widely reviled by patients and doctors alike. PA occurs when a “payer,” typically a health insurer, requires additional approval before consenting to pay doctors for certain procedures, treatments, or services. The administration loudly pledged to reduce use of PA by private payers, but four days later, unveiled WISeR, which will turbocharge PA’s use by the largest payer in the country.

Bringing PA to Medicare represents a significant change to what has historically been a manual review process conducted by recovery audit contractors (RAC).

Following the six year pilot, the longer-term impact will be evaluated using process measures like satisfaction scores and downstream clinical outcomes data. If officials like what they see, language throughout the announcement suggests that both the geography as well as the list of services could expand following the pilot.

One possibility is that this could be scaled to all of Medicare. In 2024, the program had 33.2 million beneficiaries nationwide. The six states account for nearly one fifth of all Medicare beneficiaries, or about 6.4 million people. This means WISeR will impact care for nearly 1 in 5 adults insured by Medicare, with the biggest impact felt in Oklahoma and Texas.

A more distant possibility is that this expands to the 33.4 million Americans insured by Medicare Advantage plans, too. As per their RFA, “CMS considered inclusion of items and services that are already subject to prior authorization by other payers, including MA plans, which will help promote multi-payer alignment.”

Regulatory experts from JD Supra wrote in a recent commentary: "The model represents an attempt to level the playing field between MA and FFS by bringing consistent administrative tools to coverage decisions in both programs. By introducing technology-driven prior authorization into FFS, CMS may be working toward a more uniform set of administrative rules across Medicare, so that providers are subject to the same accountability standards regardless of whether they treat a beneficiary enrolled in MA or in Medicare FFS.”

A CMS reimbursement consultant I spoke with shared doubts that the WISeR program will scale nationally, pointing to the administration’s emphasis on rhetoric over results, as well as atypically quick launch and lack of industry engagement for this initiative.

“They want the flexibility to test more robust utilization management in FFS,” he said, "without having to commit to it for a longer period of time by doing it through regulation." He shared a guess that given the especially short timeline for the RFA application (less than a month), WISeR may be, “a pet project of someone friendly with the new administration,” to leverage AI-driven private equity playbooks in Medicare.

As the Center for Policy and Economic Research argued, “There is no evidence that these for-profit actors would prioritize ensuring access to health care and denying low-value care as narrowly as possible over simply maximizing their profits.”

Former head of CMS, Dr. Donald Berwick has also weighed in: “But look closer. In this demonstration program, “participants” (i.e., the companies that win contracts) will be rewarded based on the “effectiveness of their technology solutions” for reducing spending on medically unnecessary or non-covered services. Participants will receive a percentage of the savings attributed to their reduction of wasteful or inappropriate care for each selected service. In other words, the more care they deny, the more money contracting companies make. What could possibly go wrong?”

Undermining Patient Care

While crushing fraud, waste, & abuse of taxpayer dollars is a laudable goal, WISeR faces early skepticism for bringing for-profit tech companies between patients and doctors.

In a market-driven healthcare system, altering physicians’ practice behavior with financial incentives will have direct clinical consequences.

“I have many concerns with the WISeR program,” said Dr. Joshua Rosenow, director of functional neurosurgery at Northwestern University’s Feinberg School of Medicine and practicing neurosurgeon at the university’s health system. “Prior Authorization is a significant impediment to care for patients. Doctors have to spend time on these requests, devote energy to fight denials, and money to employ staff to deal with this.”

Beyond his work fighting PA in Medicare Advantage, Rosenow points to broader public health reforms through the No Pain Act, 21st Century Cures Act, and other federal initiatives that would be undermined by WISeR.

“We spent a decade and a half moving people away from opioids. Now we could go from trusted conversation and two-way care planning, to these roadblocks of denials and disincentives. For patients with chronic pain, or with growing symptoms from Parkinson’s disease or epilepsy, their doctors will have to put compliance before care."

Anesthesiologist and pain medicine expert Dr. David Provenzano pointed out that “there are not many other options for some of these patients.” As the President of Pain Diagnostics and Interventional Care, a medical practice in Western Pennsylvania, Provenzano argues that physicians determine appropriate utilization based on a patient’s individual needs, evolving clinical guidelines and emerging standards of care for innovative treatment.

While his home state will not be impacted by WISeR, Provenzano anticipates the clinical impact will be substantial. Whereas CMS’s past pre-approval processes for spinal cord stimulation targeted certain inpatient settings, WISeR will impact private practices and ambulatory surgical centers as well. He echoed the prediction that WISeR will “significantly increase the administrative burden, cause serious staff burnout, delays of care, denials of payment. It’s another hurdle and a substantial cost.”

Impact on Innovation

Key details, including which CPT billing codes are in the crosshairs, are forthcoming. The pace of the pilot’s ramp up, along with the impact of 100 new CMMI hires "with subject matter expertise in economics, clinical and data,” are also key variables. But all these known unknowns point to the next six years of this pilot adversely impacting neurotech’s clinical outcomes and commercial success.

To start with business: How much money is at risk for neurotech companies? If all eligible claims for shortlisted services are denied (which is unlikely), then a back of napkin estimate suggests a maximum revenue loss of 20 percent.

By revenue, the biggest losers look to be the largest medical device companies Medtronic, Boston Scientific, and Abbott, who posted 2024 US neuromodulation revenues of $1.3 billion, $847 million, and $767 million respectively. FFS Medicare reimbursements on targeted procedures represents a percentage of those figures, ballpark 30%. This means that even a full 20% loss of Medicare revenue would only amount to a tiny sliver of their global bottom line across their entire diversified businesses, each over $10 billion per year.

The impact on non-diversified companies appears more damaging, due to intense competition from within neurotech and beyond. Take Inspire Medical, whose hypoglossal nerve stimulation is used to treat obstructive sleep apnea to the tune of $771 million in 2024 US revenue. In their 2024 annual report, Inspire shared that fee-for-service Medicare accounts for 25-30% of this figure, or $200-230 million. A 20% cut could represent a loss of $40-50 million.

Inspire could theoretically earn back this loss through other markets, states, or overall growth. But as a non-diversified company already facing numerous challenges and new headwinds like GLP-1s, WISeR comes at the wrong place and time, for Inspire and other players in the field.

Beyond impacting revenue, WISeR could decelerate M&A. Pain implant company Nevro, who generated just north of $350 million in 2024, was hunting for a buyer before this spring’s all-cash sale to Globus Medical for $250 million. If perception grows that implanted neuromodulation is on the wrong side of the crosshairs, it’s easy to imagine deals like this falling through in the coming years.

A Nervous System

When I asked what he would say to neurotech executives about WISeR, the reimbursement consultant I spoke with offered this view: "I’d say this is a signal the new administration is looking less kindly on companies that make a lot of money doing expensive and marginal benefit treatments. If you’re thinking about launching a $100,000 research platform for niche medical conditions, especially if your treatment has marginal benefit, you should probably pay attention to this."

How will the industry respond? In the short term, impacted companies may divert sales and marketing resources to other states, or possibly reallocate these resources towards alternative services or other federal markets, like the Veterans Administration or Medicare Advantage.

Longer term, the medical device lobby and various advocacy organizations are sure to weigh in against WISeR’s post-pilot expansion. But beyond simply outsourcing their policy battles, it would be wiser for neurotech companies and their investors heed this latest CMMI program as a wakeup call at their next board meeting.

Acknowledge Reality: Neurotechnology may not deserve a “low value” label, but a consensus has been years in the making, and not by accident. In their recent webinar CMS officials shared how they defined the specific “low-value services” chosen for this model, pointing to a recent paper, prior work by American Board of Internal Medicine, the Lown Institute, MedPac, reports and conversations with the Office of the Inspector General, the Department of Justice, as well as work within CMS, such as the Center for Program Integrity, Medicare Improper Payment Measurement Programs, and the Coverage Analysis Group at the Center for Clinical Standards and Quality.

Pay Attention: Each expert I spoke with remarked that the BCI sector should be paying close attention to WISeR given the inclusion of deep brain stimulation (DBS) on the list. But despite the program’s direct targeting of neurotech treatments, only one of the half-dozen BCI companies I spoke to was aware of its existence. By email that executive told me he thought that as an emerging technology focused on well-defined populations with severe paralysis, BCI would not be high on CMS’s prior auth list.

Even so, this pre-revenue industry has collectively taken Morgan Stanley’s market outlook as a sure thing, including it directly in press releases and corporate material. But the focus on raising money against multi-billion dollar valuations instead of wonky multi-million dollar papercuts (or the country’s disability program) might offer a preview of what’s next on the hype cycle.Demonstrate Outcomes: In neurology, psychiatry, and beyond, implanted devices cannot compete with pills on cost alone. The experts I spoke with encouraged startups to work on demonstrating value by investing in long term clinical outcome studies. This could entail moving beyond purely industry-funded research and forging multi-stakeholder collaborations to develop real-world evidence. It could mean incorporating digital therapeutics, novel biomarkers, pharmaceutical drugs, and consumer tech into studies (or treatments.)

For next gen startups with less invasive or temporary implants, demonstrating clinical equivalency to more expensive implants could usher in more nuanced assessment of value. For neural implants, the work of the iBCI-CC to advance quality of life measures, activities of daily living (ADL), and usability factors will be a boon.Shift Narratives: As politics evolve, so should evidentiary toolkits. Tying strong data to innovation stories (and vice versa) will be needed in the new Washington. This will be a challenge for implant startups in crowded markets for migraine, bladder control, sleep apnea, where scientific or technical breakthroughs don’t matter to bureaucrats and bean counters.

It should be easier for BCI given the longer time to market and popular appeal: “Show, don’t tell” advances like Synchron’s Apple partnership and Neuralink’s guerilla marketing can change hearts before minds. Precision’s unique 510k clearance brings them flexibility and versatility to explore high-bandwidth data applications and accelerate storytelling around novel use cases in several directions at once. As more next-gen companies emerge over the next six years, we’ll see further separation of neurotech’s past and future.

With known and unknown unknowns, this much is clear: Starting in January, this pilot program will impact the patient-doctor relationship, clinical and economic outcomes, and neurotech revenue in six states for six years. Those paying attention understand that seemingly direct contradictions between the intentions of this program and concurrent public-private efforts is a feature, not a bug of this administration’s governing style.

So, to beat WISeR, neurotech will have to get smarter.

Originally published in Forbes on August 27, 2025.

Very insightful Naveen, thanks!

How do you see non-invasive neuromodulation devices arena in this? Will they be affected at all in a second/later wave, or could they potentially help create precedent case studies of benefits?